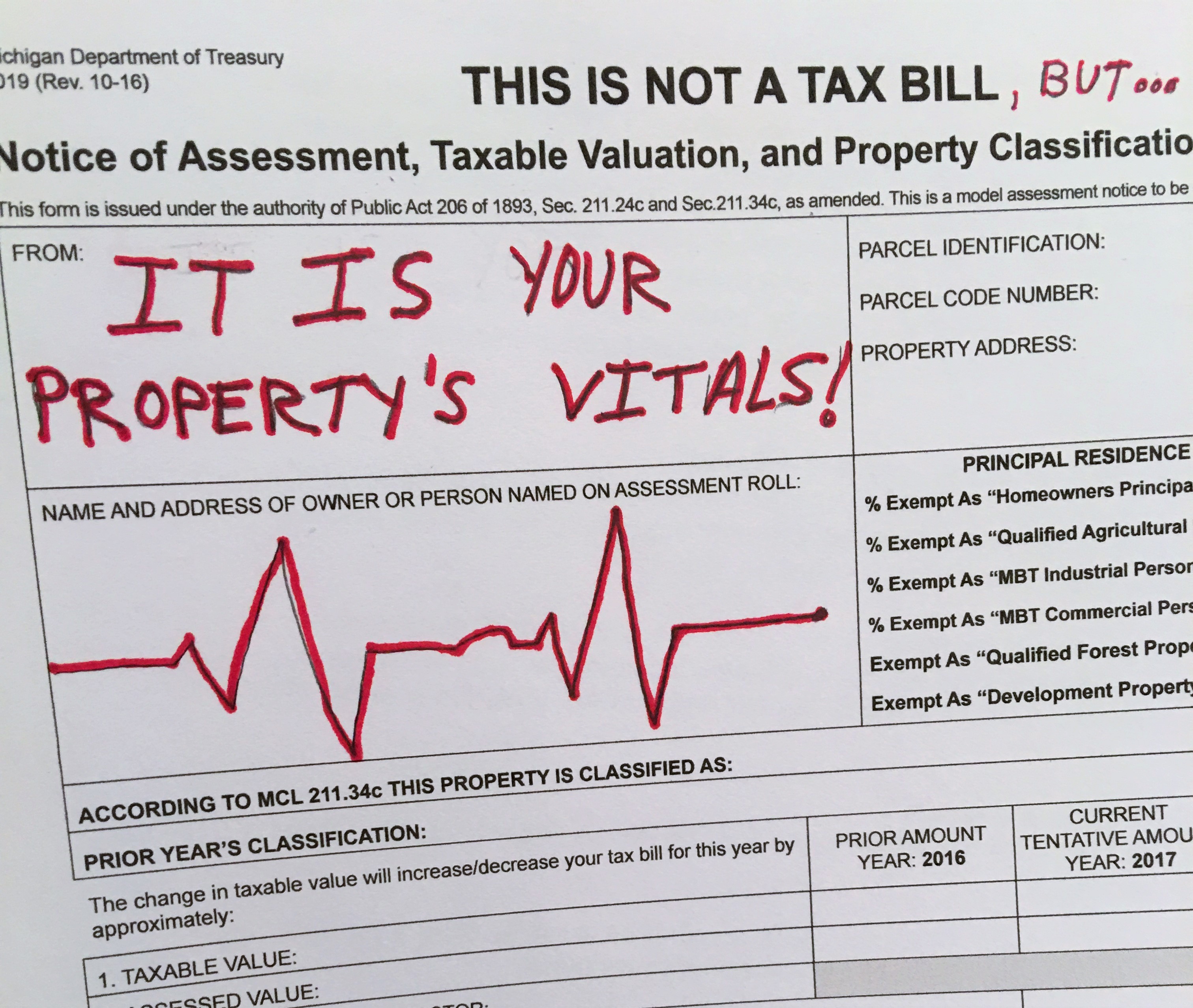

Every year the Assessor is tasked with placing an updated assessment on your property. What is your property worth to a potential buyer? Well, this information, along with many other important details are located on your Assessment Notice – your property’s vitals are coming your way in February. This outline applies to Commercial, Industrial and Residential property types.

This Is NOT A Tax Bill

Correct, your property taxes are not communicated on this notice. However, you can determine what your 2017 property tax burden will be by reviewing the Taxable Value. Your new 2017 taxes can be estimated by multiplying the 2016 Millage rate by your 2017 taxable value. For most property owners, unless you added value to your property in 2016 or purchased in 2016, your annual property tax burden will only increase slightly.

I Purchased My Property In 2016, What Does This Mean For Me?

If you purchased your property in 2016, your Taxable Value will uncap this year and become the same value as your SEV (State Equalized Value). Then your Taxable Value will recap this year, and only increase by the CPI or 5%, whichever is less, in future years.

What Does The Assessor Believe My Property Is Worth? Why?

The SEV (State Equalized Value) represents 50% of what the Assessor believes your property is worth as of December 31, 2016 or Tax Day. If your SEV is $100,000, the Assessor believes your property to be worth $200,000 on the open market. If your SEV is $1,000,000, the Assessor is suggesting your property is worth $2 Million to a potential buyer. Your Assessment & SEV change each year to represent fluctuations in the market. Assessor’s work with market data to adjust their cost approach to value (mass appraisal technique / cost new less depreciation, more can be found on my previous post).

My Taxable Value Increased Beyond The CPI…

When you add value to your property, the taxable value will be impacted. Did you renovate the bathroom or add a deck to your property in 2016 (see this interesting article from marketwatch.com for more on this)? Did a new tenant build-out a newly leased spaced? If so, then there is a good chance that some value will be added to your property per the rules of the Michigan General Property Tax Act. General maintenance items such as new windows, a roof, or painting will not be added to your Taxable Value. Assessors are supposed to only add value to the extent that it adds value to the real estate. For example, a $50,000 kitchen remodel does not mean $50,000 is added to your properties value (or $25,000, which 50% of the new construction - added to your Taxable Value).

Home Owners - Are You Receiving The PRE (Principal Residence Exemption)?

If you qualify and filed the appropriate paperwork, you will be notified on your Assessment Notice every year the % of the PRE you are receiving. In most instances, it will be 100%. If you own and occupy the property as your Principal Residence, and the % is anything but 100%, call your Assessor immediately. If your property is classed as Agricultural or used for Agricultural Purposes, you should also see a % indication here.

I Disagree With The Valuation Of My Property

The March Board of Review is the first step towards reducing an inflated Assessment. The dates and times can be found on your Assessment Notice. The window is small to gather data and protest your value to the March Board of Review, so make sure you review and are comfortable with your 2017 Assessment. Understanding your Assessment places you on track to a fair property tax valuation.