The Homestead or Principal Residence Exemption is a huge tax break. There are simple rules that apply, but you need to understand them. If you or a client qualify, read this to understand how to take advantage of the tax break.

What the Principal Residence Exemption does for You

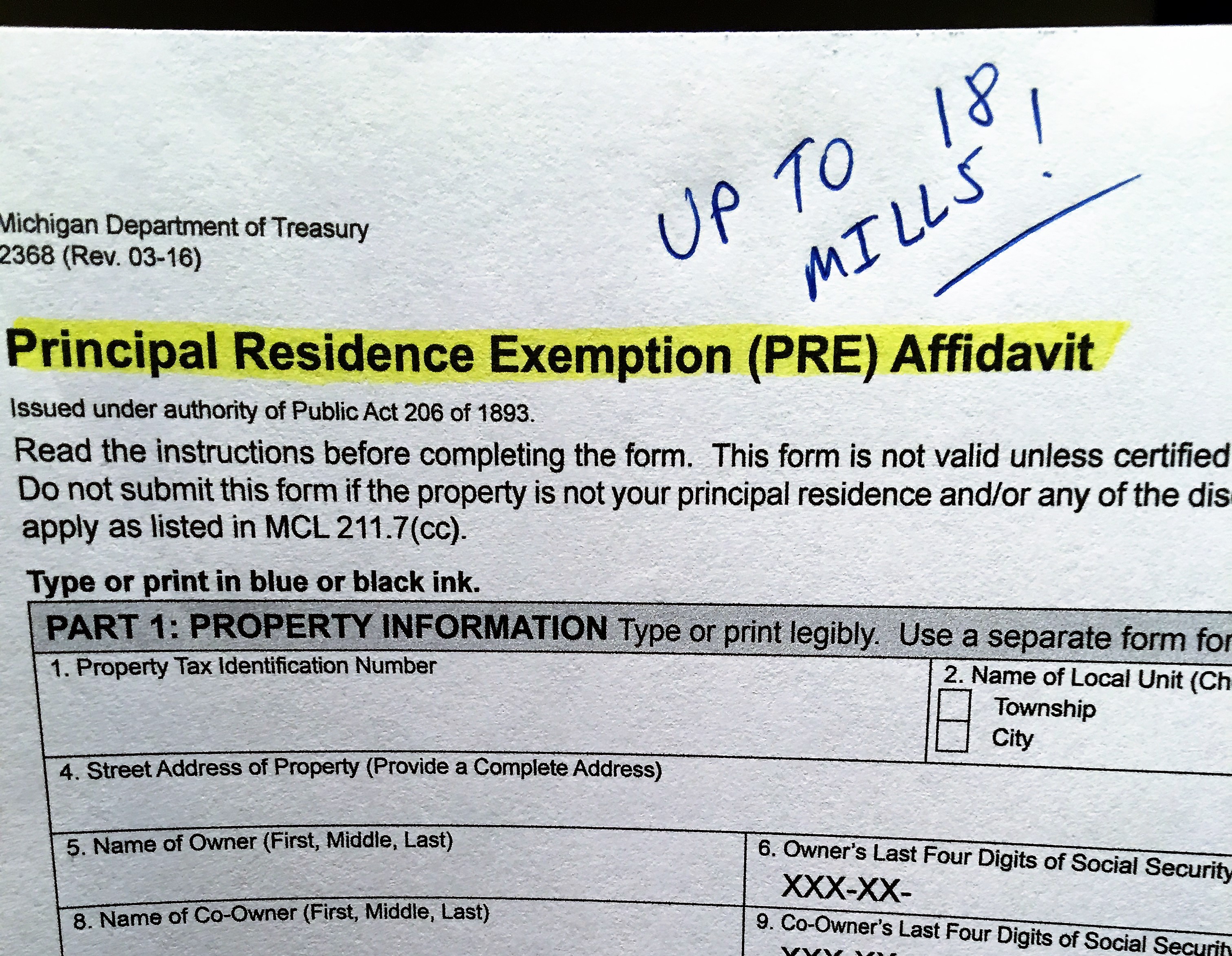

At its simplest, the Homestead Exemption (referred to as PRE or Principal Residence Exemption going forward) is an 18 millage point break for property tax on the property in which you primarily reside. For example, if the millage rate for your city or township is 50 mills / millage, you will pay 50 mills for property taxes on any piece of real property. However, if you qualify AND file the appropriate paperwork that signifies you qualify for the PRE, the mills will be much less. If you do qualify, instead of paying property taxes based on 50 mills, you pay property taxes based on 32 mills (50 mills – 18 mills = remaining 32 mills).

An Example

Being exempt from paying the 18 mills is a huge break. Let’s consider a $500,000 house (I wish I lived in one): if the Assessed Market Value is $500,000, we know the State Equalized Value & Taxable value will be at 50% or $250,000. If you don’t file the appropriate PRE affidavit (more information, and the form can be found here), you will be paying taxes as follows: $250,000 x .05 mills = $12,500. If you qualify, and file the appropriate paperwork / affidavit, you will be paying taxes as follows: $250,000 x .032 mills = $8,000. $12,500 in annual property taxes is + $4,500 more than the exempt $8,000 amount. Taking advantage of this exemption reduces the annual tax burden by 36% - nice!

The Rules

A person must own and occupy the property as his or her primary residence. Person means individual- no partnerships, LLC’s or other legal entities. If the person owns 1% or more of the property and occupies the property as their principle residence (and can prove it), they are entitled to this exemption. A few items that can be used to support a property as your principal residence are: voter registration, income tax returns, driver’s license & canceled checks.

Some Interesting Things the Assessor Can Do

If you qualified for the PRE (Principal Residence Exemption) and did not file the appropriate documents to apply for the exemption, the Board of Review has the authority to grant exemptions for previous years. For example, if you purchased your home in 2014 but didn’t apply for the PRE tax break until 2016, the Board of Review (March, July & December) has the authority to grant the exemption for the “current and three immediately preceding” years. In this scenario, the property owner would have over paid their annual property taxes for 2014 & 2015, and would be entitled to a refund for overpayment of property taxes.

There are many other nuances with this exemption, such as partial exemptions, conditional PRE’s if you are trying to sell a home (and already moved into your new home), and denials of PRE’s. Now you know the basics, and this should apply to most PRE situations.